Introduction

When a company decides to raise funds or allow its promoters to offload shares to the public, it can do so through various mechanisms — the most common being IPO (Initial Public Offering) and OFS (Offer for Sale).

Both methods provide an opportunity for investors to buy shares of a company, but the purpose, process, and implications of each differ significantly.

Let’s explore what IPO and OFS mean, how they work, and what distinguishes one from the other.

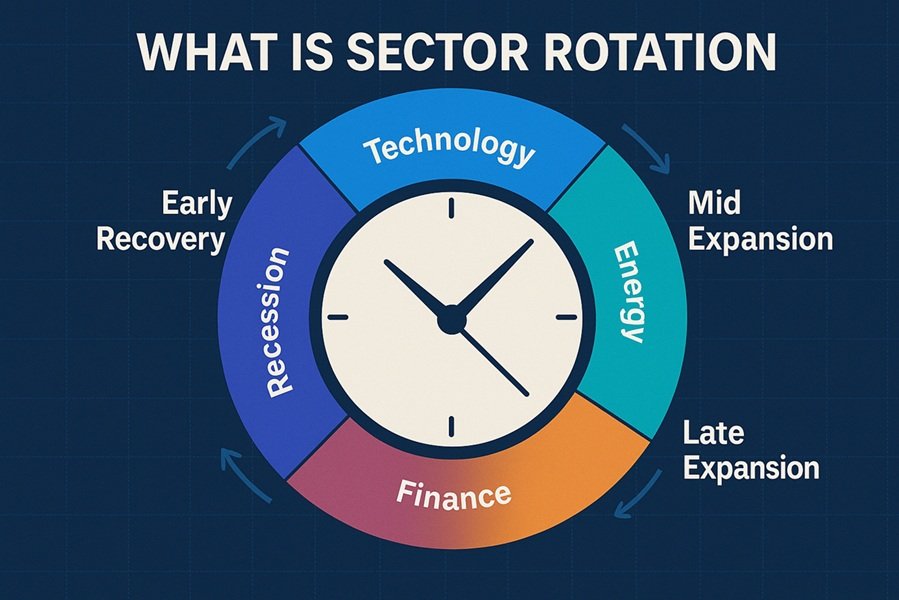

Read This also: What is Sector Rotation – Uses, Pros & Limitations

What is an IPO (Initial Public Offering)?

An IPO (Initial Public Offering) is the process by which a private company becomes a publicly traded company by offering its shares for the first time to the general public through a stock exchange.

Key Points About IPO:

- Conducted by unlisted companies looking to raise capital.

- The company issues new shares to investors.

- The funds raised are usually used for business expansion, debt repayment, or working capital.

- Requires approval from SEBI (Securities and Exchange Board of India).

- The process involves merchant bankers, underwriters, and registrars.

Example of IPO:

In 2021, Zomato launched its IPO, becoming one of India’s most talked-about public listings. The funds raised helped the company expand operations and enhance market visibility.

What is an OFS (Offer for Sale)?

An Offer for Sale (OFS) is a method that allows existing shareholders or promoters of a listed company to sell their shares directly to the public through the stock exchange mechanism.

Key Points About OFS:

- Applicable only for already listed companies.

- The company does not issue new shares; existing shareholders sell part of their stake.

- The sale proceeds go to the selling shareholders, not the company.

- Introduced by SEBI in 2012 to promote transparency in share sales.

- Usually completed within one or two trading days, making it a faster process than IPOs.

Example of OFS:

The Government of India often uses the OFS route to dilute its stake in public sector undertakings (PSUs) like Coal India, NTPC, and ONGC.

Key Differences Between IPO and OFS

| Parameter | IPO (Initial Public Offering) | OFS (Offer for Sale) |

|---|---|---|

| Meaning | Process of issuing new shares to the public for the first time. | Sale of existing shares by promoters or large shareholders of a listed company. |

| Company Type | Unlisted companies. | Already listed companies. |

| Purpose | To raise fresh capital for the company’s growth. | To allow existing shareholders to offload their stake. |

| Funds Received By | The company. | The selling shareholders (promoters/investors). |

| SEBI Approval | Mandatory and detailed regulatory compliance. | Requires only exchange intimation and limited SEBI compliance. |

| Process Duration | Lengthy process (weeks to months). | Quick process (1–2 days). |

| Intermediaries Involved | Merchant bankers, underwriters, registrars. | Minimal intermediaries; handled via stock exchange platform. |

| Price Determination | Through book building or fixed price issue. | Sellers set a floor price; bids are received above that. |

| Investor Type | Retail, QIB (Qualified Institutional Buyers), and HNI investors. | Institutional and retail investors (subject to specific quotas). |

| Dilution of Ownership | Results in dilution of promoter’s shareholding due to new shares issued. | Only transfers existing ownership; no new shares are created. |

Process of IPO and OFS

IPO Process:

- Appointment of Intermediaries – Company hires merchant bankers and underwriters.

- SEBI Filing – Draft Red Herring Prospectus (DRHP) is submitted for approval.

- Price Band & Bidding – Price range is decided and investors bid within that range.

- Allotment – Shares are allotted to successful bidders.

- Listing – Shares are listed on stock exchanges (NSE/BSE).

OFS Process:

- Announcement – Company notifies stock exchanges about the OFS.

- Floor Price – Promoters set a minimum selling price.

- Bidding Window – Investors place bids online (usually for one trading day).

- Allotment – Shares are allocated to highest bidders above the floor price.

- Settlement – Shares are transferred, and payment is made within T+1 day.

Advantages and Disadvantages

Advantages of IPO:

- Helps raise fresh funds for company expansion.

- Enhances brand value and credibility.

- Provides liquidity to early investors.

Disadvantages of IPO:

- Involves high costs and regulatory compliance.

- Risk of market volatility affecting share price.

- Requires continuous public disclosures and transparency.

Advantages of OFS:

- Simple and quick process.

- Lower regulatory requirements compared to IPO.

- Ideal for promoters to reduce holdings or meet SEBI’s minimum public shareholding norms.

Disadvantages of OFS:

- No new capital is raised for the company.

- Limited investor enthusiasm compared to an IPO.

- Short bidding period may reduce retail participation.

Which Is Better for Investors?

For investors, both IPO and OFS offer unique opportunities:

- IPO investors can benefit from listing gains and long-term growth prospects of a newly listed company.

- OFS investors get a chance to acquire shares of established, already listed firms, often at a discount to market prices.

However, OFS carries less speculative risk because the company’s performance and fundamentals are already known, unlike an IPO where the company is entering the market for the first time.

Read this also: What is Alpha and Beta in Mutual Funds? Understanding the Key Metrics of Fund Performance

Conclusion

While both IPO and OFS allow investors to buy shares and participate in the growth of companies, their objectives and structures are distinct.

- IPOs help unlisted companies raise capital and go public.

- OFS helps promoters or large investors in listed companies sell part of their holdings with ease.

In short:

👉 IPO = Fundraising + Listing.

👉 OFS = Share Sale by Promoters (No New Funds Raised).

Understanding the difference between IPO and OFS is essential for both investors and company promoters, ensuring informed participation in the capital market.