Introduction

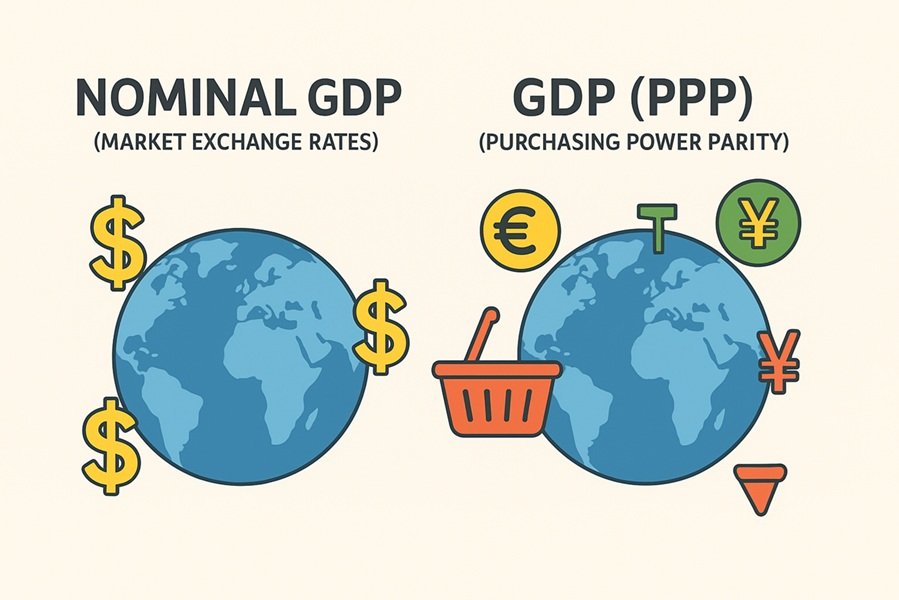

When comparing the economic strength of countries, two important terms frequently appear in discussions — Nominal GDP and GDP (PPP). While both measure the size of an economy, they do so in very different ways. Understanding the distinction between these two indicators is essential for accurately comparing economic performance, living standards, and purchasing power across nations.

This article provides a detailed explanation of Nominal GDP vs. GDP at Purchasing Power Parity (PPP), their calculation methods, differences, and why both are vital for assessing the real economic strength of countries such as India, the United States, and China.

What is GDP?

Gross Domestic Product (GDP) is the total monetary value of all goods and services produced within a country’s borders during a specific period, usually a year. It is the most widely used indicator to gauge the economic health of a nation.

GDP can be measured in several ways:

- Nominal GDP (Current Prices)

- Real GDP (Constant Prices)

- GDP (PPP) – Purchasing Power Parity

Each measure gives a different perspective on the economy, and the choice of metric depends on the purpose of analysis.

What is Nominal GDP?

Nominal GDP refers to the total value of all goods and services produced in a country, measured using current market exchange rates and current prices.

In simple terms, it measures the economy’s output without adjusting for inflation or differences in price levels between countries.

Formula:

Nominal GDP=Quantity of Goods and Services Produced×Current Market Prices

Key Characteristics of Nominal GDP:

- Calculated in U.S. dollars or the domestic currency using market exchange rates.

- Reflects current price levels, meaning inflation or deflation affects the value.

- Useful for understanding the current size of an economy in global markets.

Example:

If India’s GDP is ₹300 trillion and the exchange rate is ₹80 = $1, then:

Nominal GDP=300 trillion/80=3.75 trillion USD

What is GDP (PPP)?

GDP at Purchasing Power Parity (PPP) adjusts the GDP to account for differences in cost of living and price levels between countries. It measures what the same amount of money can buy in each country, providing a more accurate picture of real living standards and economic productivity.

Formula:

GDP (PPP)=Nominal GDP×PPP Conversion Factor

The PPP conversion factor is determined by comparing the price of a standard basket of goods and services across countries.

Key Characteristics of GDP (PPP):

- Adjusts for differences in local prices.

- Reflects the real purchasing power of people.

- Useful for comparing living standards and domestic economic strength.

Example:

If the cost of living in India is much lower than in the U.S., one dollar in India may buy goods worth $3 in the U.S. terms. Therefore, India’s GDP (PPP) is often more than double its nominal GDP.

Nominal GDP vs GDP (PPP): Major Differences

| Aspect | Nominal GDP | GDP (PPP) |

|---|---|---|

| Basis of Calculation | Market exchange rates | Purchasing power parity conversion rates |

| Adjusts for Price Levels | No | Yes |

| Influenced by Inflation | Yes | No (adjusted for cost of living) |

| Usefulness | For comparing market size and trade potential | For comparing living standards and real output |

| Example (India, 2025) | ~$4 trillion (nominal)** | ~$13 trillion (PPP) |

| Effect of Exchange Rate Changes | Highly sensitive | Relatively stable |

| Global Ranking Impact | Developed nations rank higher | Developing nations rise significantly |

Why Are Both Important?

1. Nominal GDP – For Global Financial and Trade Analysis

Nominal GDP is critical for:

- Measuring a country’s market influence.

- Determining global economic ranking by size.

- Comparing foreign investment potential.

For example, the U.S. consistently leads in nominal GDP, as its currency (USD) sets the global benchmark for trade and investment.

2. GDP (PPP) – For Real Economic and Social Comparison

GDP (PPP) reflects:

- Living standards of citizens.

- True economic productivity.

- Domestic purchasing power.

For instance, India’s GDP (PPP) ranking is much higher (3rd globally) than its nominal GDP ranking (5th or 6th), showing that while incomes are lower in dollar terms, the cost of living is also lower — allowing people to buy more goods and services with the same income.

Global Comparison (2025 Estimates)

| Country | Nominal GDP (USD Trillion) | GDP (PPP) (USD Trillion) | Remarks |

|---|---|---|---|

| United States | 29.0 | 29.0 | High nominal and PPP parity |

| China | 18.5 | 36.7 | Largest by PPP |

| India | 4.2 | 13.2 | 3rd largest by PPP |

| Japan | 4.9 | 6.3 | Stable developed economy |

| Germany | 5.1 | 5.9 | High productivity, strong euro |

| Russia | 2.1 | 5.0 | PPP much higher due to low cost of living |

India’s Position: Nominal vs PPP

India provides one of the best case studies in the nominal vs PPP debate.

- Nominal GDP (2025): Approx. $4.2 trillion, ranking 4th globally.

- GDP (PPP, 2025): Approx. $13.2 trillion, ranking 3rd globally, after China and the U.S.

This shows that while India’s income levels in dollar terms are modest, the cost of living advantage allows its citizens to afford more goods and services locally.

Which Metric Is Better?

Neither measure is “better” universally — it depends on the purpose:

- Use Nominal GDP for:

- International trade comparisons.

- Foreign exchange and investment analysis.

- Global market valuation.

- Use GDP (PPP) for:

- Comparing living standards.

- Domestic policy planning.

- Poverty and welfare analysis.

In Simple Terms:

Nominal GDP shows what the economy is worth globally,

GDP (PPP) shows what people can actually buy locally.

Real-World Implications

1. Policy Making

Governments often rely on PPP-based GDP to design welfare programs and understand real household purchasing power.

2. Foreign Investment

Investors look at Nominal GDP to assess currency stability and potential returns, but PPP GDP helps them gauge market depth and domestic consumption power.

3. International Organizations

The IMF and World Bank use both metrics:

- Nominal GDP for financial reporting.

- PPP GDP for human development and poverty assessments.

Conclusion

Both Nominal GDP and GDP (PPP) are vital for understanding a country’s economy, but they serve distinct purposes. Nominal GDP reflects the country’s global economic position, while GDP (PPP) captures the real domestic purchasing power and living conditions.

In a globalized world, where exchange rates and inflation fluctuate, economists and policymakers must use both metrics together to gain a balanced and accurate view of economic strength and human welfare.