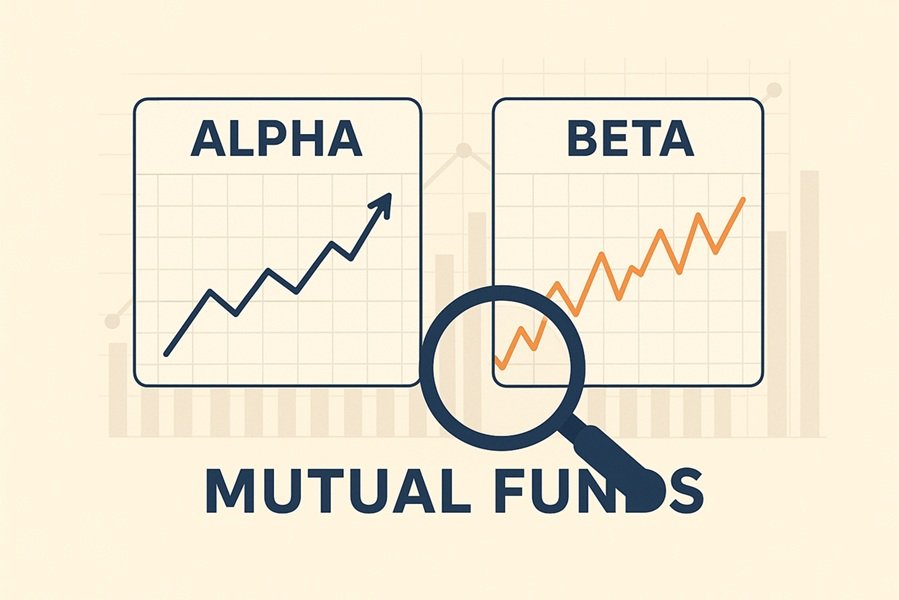

When you invest in mutual funds, analyzing their past performance is crucial to understanding whether they align with your financial goals and risk appetite. While returns are the most obvious parameter, two technical metrics — Alpha and Beta — play an equally important role in evaluating how well a mutual fund performs compared to its benchmark and how much risk it carries.

In simple terms, Alpha measures a fund’s ability to beat the market, while Beta measures how sensitive the fund is to market movements. Together, these parameters help investors make informed decisions about where to invest their money.

Read this: Difference Between IPO and OFS: Meaning, Process, and Key Differences

Understanding Alpha and Beta: The Basics

Before diving deeper, let’s understand these terms in a simple way:

- Alpha shows how much extra return (or loss) a fund has generated compared to a benchmark index.

- Beta shows how much the fund’s price fluctuates compared to the overall market.

Both are statistical measures derived from regression analysis — a technique used by analysts to compare a mutual fund’s performance with a benchmark index like Nifty 50 or Sensex.

What is Alpha in Mutual Funds?

Definition

Alpha represents the excess return of a mutual fund relative to its benchmark index. It measures how effectively a fund manager has generated returns over and above the benchmark’s performance.

Formula

Alpha=Actual Return of Fund−Expected Return based on Beta

If a mutual fund has:

- Alpha = +2, it means the fund has outperformed the benchmark by 2%.

- Alpha = -1, it means the fund underperformed the benchmark by 1%.

Example

Suppose the Nifty 50 gives a return of 10% in a year, and your mutual fund generates 12% during the same period. If the fund’s Beta is 1, meaning it moves in line with the market, then the Alpha = +2 — indicating the fund manager added extra value through smart investment decisions.

Interpretation

- Positive Alpha (+): Outperformed the benchmark.

- Negative Alpha (-): Underperformed the benchmark.

- Zero Alpha (0): Matched the benchmark.

Importance of Alpha

Alpha helps investors evaluate the fund manager’s skill. A consistent positive alpha indicates good management and a solid investment strategy, while a negative alpha suggests poor fund selection or strategy.

What is Beta in Mutual Funds?

Definition

Beta measures a mutual fund’s volatility compared to the market or benchmark index. It helps investors understand how much the fund’s returns move relative to market movements.

Formula

Beta=Covariance (Fund, Market)/Variance (Market)

Example

Let’s assume:

- Beta = 1 → The fund moves in the same direction and magnitude as the market.

- Beta > 1 → The fund is more volatile than the market (higher risk, higher potential returns).

- Beta < 1 → The fund is less volatile than the market (lower risk, stable returns).

- Beta = 0 → The fund’s performance is uncorrelated with the market.

If a mutual fund has a Beta of 1.2, it means when the market rises 10%, the fund is expected to rise by 12%; and if the market falls 10%, the fund might fall by 12% too.

Importance of Beta

Beta helps investors understand risk exposure.

- High Beta funds suit aggressive investors seeking higher returns and willing to accept greater risk.

- Low Beta funds suit conservative investors prioritizing stability and capital preservation.

Key Differences Between Alpha and Beta

| Parameter | Alpha | Beta |

|---|---|---|

| Definition | Measures fund performance relative to benchmark | Measures fund volatility relative to market |

| Indicates | Fund manager’s skill and value addition | Fund’s sensitivity to market movements |

| Ideal Value | Positive (greater than 0) | Around 1 (depending on risk appetite) |

| Type | Performance metric | Risk metric |

| Focus | Return enhancement | Risk management |

| Investor Use | To choose outperforming funds | To choose suitable risk exposure |

How to Use Alpha and Beta Together

While Alpha and Beta provide different insights, they are most useful when analyzed together:

- High Alpha, Low Beta:

Ideal combination — the fund delivers high returns with low volatility.

Example: A well-managed diversified equity fund. - High Alpha, High Beta:

High returns but with high risk — suitable for aggressive investors. - Low Alpha, Low Beta:

Stable but low-return fund — suitable for conservative investors. - Negative Alpha, High Beta:

Worst combination — poor returns and high volatility. Best to avoid.

Real-World Example

Let’s say you’re comparing two mutual funds:

| Fund Name | Return (%) | Beta | Alpha |

|---|---|---|---|

| Fund A | 14 | 0.9 | +2 |

| Fund B | 18 | 1.4 | -1 |

Analysis:

- Fund A: Slightly lower return but better Alpha and lower Beta — stable and efficiently managed.

- Fund B: Higher return but negative Alpha — meaning the fund manager didn’t add value; returns came from taking higher market risk.

Thus, Fund A may be a better long-term choice for balanced investors.

Alpha and Beta in Different Mutual Fund Categories

| Fund Type | Typical Beta Range | Alpha Potential |

|---|---|---|

| Large Cap Funds | 0.9 – 1.1 | Moderate |

| Mid Cap Funds | 1.1 – 1.3 | High |

| Small Cap Funds | 1.3 – 1.6 | Very High |

| Hybrid Funds | 0.6 – 1.0 | Moderate |

| Debt Funds | 0.2 – 0.6 | Low |

Understanding this helps you choose funds according to your risk-return profile.

Limitations of Alpha and Beta

While useful, Alpha and Beta have certain limitations:

- They are based on historical data, not future predictions.

- Beta does not account for unsystematic risks (like company-specific events).

- Alpha can vary with market cycles — a fund with positive alpha in a bull market may perform differently in a bear market.

- Different data providers may use slightly different benchmarks, affecting results.

Therefore, use these metrics alongside others like Sharpe Ratio, Standard Deviation, and Expense Ratio for comprehensive analysis.

Read this: What is Sector Rotation – Uses, Pros & Limitations

Conclusion: Why Alpha and Beta Matter

In mutual fund investing, understanding Alpha and Beta is like reading a car’s dashboard before driving. Alpha tells you how well the driver (fund manager) is performing, while Beta tells you how bumpy the ride might be.

- If you want stability, look for funds with low Beta and positive Alpha.

- If you can tolerate higher risk, funds with slightly higher Beta but strong Alpha may suit you better.

By combining both metrics, investors can balance returns and risk, leading to smarter, data-driven investment decisions.