Introduction

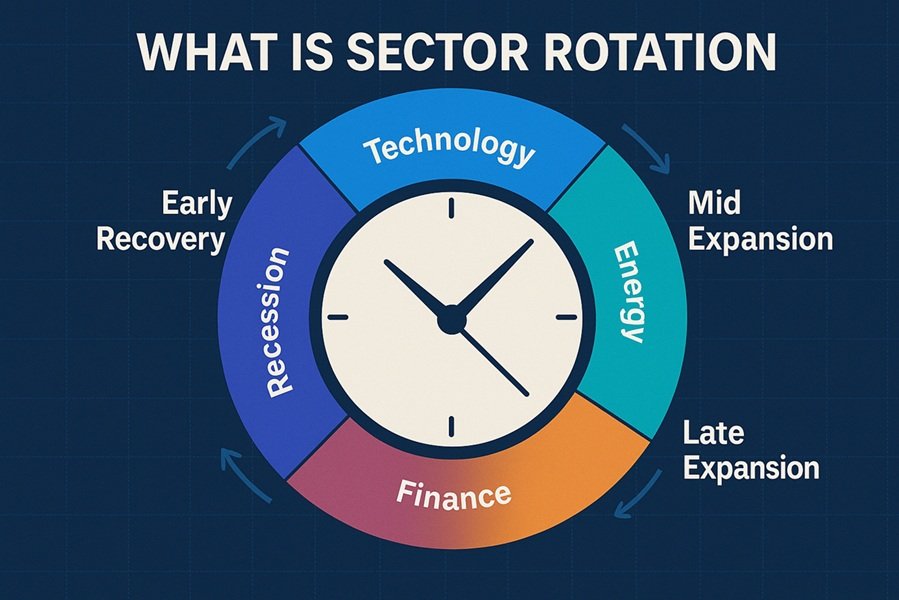

The stock market moves in cycles, and different sectors outperform during different stages of the economic cycle. This is where the concept of sector rotation comes into play.

Sector rotation refers to the investment strategy of shifting money from one industry or sector to another to take advantage of changing economic trends and business cycles. It’s a dynamic approach that helps investors optimize returns by investing in sectors expected to perform well in the current market environment.

Let’s understand how sector rotation works, its uses, benefits, and limitations in detail.

What is Sector Rotation?

Sector rotation is an investment strategy that involves moving investments between different sectors of the economy depending on the stage of the business or economic cycle.

For example, when the economy is expanding, sectors like technology, finance, and consumer discretionary often perform well. But when the economy slows down or enters a recession, investors may rotate into defensive sectors like utilities, healthcare, and consumer staples that tend to perform better during downturns.

The idea is to “ride the wave” of outperforming sectors and exit before they lose momentum.

Read This: Difference Between IPO and OFS: Meaning, Process, and Key Differences

How Sector Rotation Works

Sector rotation is based on the concept that the economic cycle consists of distinct phases — expansion, peak, contraction (recession), and recovery. Each phase favors specific sectors.

Here’s a simplified example:

| Economic Phase | Expected Leading Sectors |

|---|---|

| Early Recovery | Consumer Discretionary, Technology, Financials |

| Mid Expansion | Industrials, Energy, Materials |

| Late Expansion | Real Estate, Commodities |

| Recession | Healthcare, Utilities, Consumer Staples |

Investors who follow sector rotation analyze macroeconomic indicators such as GDP growth, inflation rates, interest rates, and employment data to predict where the economy is heading and which sectors are likely to benefit.

Types of Sector Rotation Strategies

There are several ways investors and fund managers implement sector rotation:

1. Business Cycle Rotation

This is the most common type. Investors shift sectors based on where the economy stands in the business cycle (expansion, contraction, recovery, etc.).

2. Seasonal Rotation

Certain sectors perform well during specific seasons or times of the year. For example, retail stocks often rise during the holiday season.

3. Technical Sector Rotation

This involves using technical analysis tools such as moving averages, relative strength index (RSI), or price momentum to determine which sectors are gaining strength.

4. Thematic Rotation

Investors may rotate sectors based on emerging themes like green energy, artificial intelligence, or infrastructure development.

Uses of Sector Rotation Strategy

1. Enhancing Portfolio Returns

By investing in sectors expected to outperform, investors can potentially achieve higher returns compared to a static portfolio allocation.

2. Managing Market Risk

Sector rotation helps investors reduce exposure to sectors that may underperform due to economic slowdown or policy changes.

3. Capturing Market Trends

It allows investors to take advantage of short- to medium-term market trends and capitalize on shifting investor sentiment.

4. Diversification Across Economic Cycles

Rotating investments across various sectors ensures that a portfolio is not overexposed to a single industry, enhancing long-term stability.

5. Tactical Asset Allocation

Institutional investors and mutual fund managers often use sector rotation as part of a tactical allocation strategy to outperform benchmarks like the Nifty 50 or S&P 500.

Pros of Sector Rotation

1. Potential for Outperformance

Investors can achieve better returns by staying ahead of the economic curve and moving capital into sectors likely to outperform.

2. Flexibility

Unlike passive investing, sector rotation is an active strategy, allowing flexibility to respond to new market data and global events.

3. Hedging Against Downturns

By moving funds to defensive sectors during a market downturn, investors can minimize losses.

4. Leverages Economic Insights

Sector rotation utilizes economic indicators, making it a data-driven and research-based approach to investing.

5. Opportunity for Short-Term Gains

Traders and active investors can benefit from short-term sector-specific rallies using ETFs or sector-based mutual funds.

Limitations of Sector Rotation

Despite its advantages, sector rotation is not foolproof. It comes with several challenges and limitations:

1. Timing Risk

The biggest risk is incorrect timing. Predicting the exact phase of the business cycle is difficult, and mistimed rotations can lead to losses.

2. High Transaction Costs

Frequent buying and selling of sector ETFs or stocks can lead to high transaction costs and tax implications.

3. Requires Expertise

Effective sector rotation demands a deep understanding of macroeconomics, market cycles, and sector dynamics — which can be challenging for retail investors.

4. Short-Term Focus

Constantly shifting sectors can make investors overly focused on short-term gains instead of long-term wealth creation.

5. Not Always Effective in Uncertain Markets

During periods of market uncertainty or global crises (like pandemics or geopolitical conflicts), sector correlations may break down, making rotation strategies less effective.

Real-World Example of Sector Rotation

Consider the COVID-19 pandemic (2020):

- Before the pandemic, travel, energy, and banking sectors were performing well.

- When lockdowns began, investors rotated to technology, healthcare, and consumer staples, as these sectors thrived during remote work and healthcare demands.

- As recovery began in 2021, investors moved back to industrials, real estate, and energy, expecting economic rebound.

This real-world scenario demonstrates how sector rotation follows changing economic environments.

How to Implement a Sector Rotation Strategy

- Study the Economic Indicators: Track GDP growth, inflation, employment data, and central bank policies.

- Identify the Economic Phase: Determine if the market is in expansion, peak, contraction, or recovery.

- Select Sectors Accordingly: Use business cycle models to choose sectors expected to perform well in that phase.

- Invest Through ETFs or Mutual Funds: Sector ETFs (like Nifty IT ETF, SPDR Energy ETF) make it easier to rotate exposure without stock-picking.

- Monitor and Adjust Regularly: Economic conditions evolve, so regular portfolio reviews are essential.

Read This also: What is Alpha and Beta in Mutual Funds? Understanding the Key Metrics of Fund Performance

Conclusion

Sector rotation is a powerful investment strategy that helps investors align their portfolios with economic cycles to enhance returns and manage risks. However, it demands timing precision, market knowledge, and discipline.

While institutional investors and experienced traders often use sector rotation effectively, retail investors should apply it cautiously — ideally through diversified sector ETFs or under professional guidance.

In short, sector rotation works best when combined with sound research, patience, and an understanding of macroeconomic trends.